Sunday, July 27, 2014

Do you remember Healthcare.gov Website launch?

Do you all remember the launch of the healthcare.gov website for purchasing health insurance policies? It was in the news for months as a disaster. Things are finally mostly under control, but it is still a burden for the average person to use. There are so many options and so many ways that you can get the wrong subsidy or buy a plan that doesn't cover what you think it does or doesn't have the doctors or hospitals you rely on. The worst part is that once you buy a plan you are locked in for a year. That means that you can't make a change. Fortunately you have the option of using a licensed agent that has been trained in the marketplace and in the health insurance plans that are offered. One of the best features of using an agent is that you do not pay anything additional for their service. They are compensated by the insurance company. Your premium and subsidy are EXACTLY the same as if you did it yourself, except you are getting professional advice and service. If you do it yourself and run into a problem you can't call an agent in and expect help. You will have to rely on healthcare.gov for service. All of the agents that work with Berlin & Denys Insurance have been through extensive training and are certified by the government before they can advise someone. Give us a call at 800-946-3303 or visit our website at http://www.berlindenys.com. Berlin & Denys Insurance has been Bringing Good People and Good Plans Together for over 30 years.

Friday, July 25, 2014

New IRS Health Insurance Reporting Forms

The IRS released the draft forms for reporting if you have health insurance for the next tax season. You will be required to fill them out and send them in with your taxes. It tells them if you had insurance and figures out if you owe a penalty tax. Take a look at the link to see one of the draft forms. What do you think about this? If you think it is fair or unfair, please leave a comment and tell us why. If you need coverage, please give us a call at 800-946-3303 or visit our website at berlindenys.com

http://www.irs.gov/pub/irs-dft/f1095a--dft.pdfWednesday, July 23, 2014

When your life changes, your health plan may need to change, too.

When you have big changes in your life, you have 60 days to get a health plan or make changes to the policy you already have. We can help you get the plan you now need.

What kind of ‘life changes’ qualify?

You may be eligible for the 60-day special enrollment period to get a new plan if:

You may be eligible for the 60-day special enrollment period to get a new plan if:

- You move to a new area that offers you different plans

- You get married or have a newly eligible domestic partner and/or dependent

- You have a baby or adopt a child or have a foster child placed with you

- You lose your health coverage due to job loss, a decrease in work hours, before you start or end COBRA coverage or other reason

- You are eligible for COBRA, but have not started the coverage

- You became a U.S. citizen, national or lawfully present (i.e. Green Card, Visa)

- Your income changes, or some other event changes your income or household status

- You lose your coverage because you are no longer covered on a family member’s policy, you get divorced or legally separated from your spouse, or the policy holder has passed away

This list doesn’t include all qualifying life events and you may have a special situation. Talk to us to find out if your specific event qualifies and then we’ll help you enroll in a plan that best meets your needs and budget. Even though the open enrollment period to buy a health plan isn’t until this fall, you may be eligible to take advantage of this special enrollment opportunity right now.

How long do I have to enroll in a plan after a qualifying event? It depends on the event, since some allow you to enroll in a plan 60 days before and some 60 days after the event. Talk to us and we’ll let you know, based on your individual situation.

Can I get help paying for my health plan if I qualify for a special enrollment? Yes, the government may help pay for some or all of your plan. We can help you find out if you’re eligible for a government subsidy.

Talk to us today one-on-one for answers to your specific health insurance questions. We can explain your options and help you through your next steps.

Call: 1-800-946-3303

Visit: www.berlindenys.com

Call: 1-800-946-3303

Visit: www.berlindenys.com

Monday, July 21, 2014

Tuesday, July 15, 2014

What is Health Care Reform?

Berlin & Denys Insurance can help you figure out how to get the coverage you are required to have at a cost that you can afford. Give us a call at 800-946-3303 or visit us on Facebook or our company website.

Friday, July 11, 2014

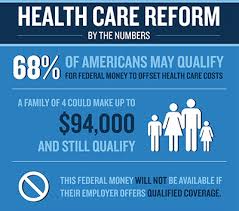

Health Care Reform By the Numbers

What does all this talk about Health Care Reform really mean? Do I really have to do something? What if I don't want to? What fines may I have to pay? I heard I may be able to get help from the government to pay for my coverage, how does that work? Berlin & Denys Insurance can answer your questions at no cost to you and guide you to find the best options at the best premium. Check out this interactive subsidy calculator. It can estimate your Federal subsidy in just 1 minute. http://kff.org/interactive/subsidy-calculator/ We have been doing this for over 30 years. Berlin & Denys insurance "Bringing Good People and Good Plans Together" http://www.berlindenys.com/

What does all this talk about Health Care Reform really mean? Do I really have to do something? What if I don't want to? What fines may I have to pay? I heard I may be able to get help from the government to pay for my coverage, how does that work? Berlin & Denys Insurance can answer your questions at no cost to you and guide you to find the best options at the best premium. Check out this interactive subsidy calculator. It can estimate your Federal subsidy in just 1 minute. http://kff.org/interactive/subsidy-calculator/ We have been doing this for over 30 years. Berlin & Denys insurance "Bringing Good People and Good Plans Together" http://www.berlindenys.com/

Are you leaving money on the table?

Many people will qualify now for savings while some will need to wait until the Open Enrollment period. This year the Enrollment period starts November 15th. Don't miss out on the possible huge savings! Please call us at 800-946-3303 with questions or visit http://www.berlindenys.com/ and run your own quotes. Berlin & Denys Insurance has been "Bringing Good People and Good Plans" to Florida residents for over 30 years.

Tuesday, July 8, 2014

When you are sick or hurt and can't work......

Most people think that having life insurance and health insurance is enough. What some do not realize is that if you can't work you normally do not get paid. How would your family survive financially if you had an injury or sickness that caused you to be unable to work. Most people can't answer that question. Please take a look at the video and contact us at 800-946-3303 if we can help.

Monday, July 7, 2014

Why you should be a quitter!

|

| Originally Posted on http://blog.floridablue.com |

It’s okay to be a quitter when

you’re quitting a bad habit like smoking. In fact, if you’re a smoker,

quitting smoking is the single most important step you can make

toward a longer, healthier life. Unlike some healthy lifestyle changes

that take time to make a difference (such as eating better or

working out), quitting smoking has immediate health

benefits.

For example, in:

• 20 minutes your blood

pressure and your heart rate to normal levels

• 24 hours the carbon

monoxide level in your blood to normal

• 2 weeks your risk of heart

attack begins to decrease and your lung function will greatly improve

• The long term your overall

risk for heart disease, stroke and cancer decreases

Here are 5 Tips on how to quit

smoking:

1.

Set a “quit

smoking” date. Mark the date on a calendar and focus your attention on your

first step toward a healthier lifestyle.

2.

Identify (and

avoid) your smoking triggers. Examples include enjoying your morning cup of

coffee or seeing an ashtray. Opt for tea instead and remove smoking reminders.

3.

Have healthy

snacks on hand to curb cravings. Stock up on sugar-free gum or hard candy for

when you crave a cigarette (especially in the beginning).

4.

Get moving.

Physical activity can help ward off nicotine cravings and also help reduce

stress.

5.

Look for

support. Tell your friends and family you’re quitting so they can support your

decision. You can also join a support group in your area (check out Cancer.org

or LungUSA.org for groups near you).

Before your quit date, you may

want to talk to your doctor about nicotine replacement therapy (gum, lozenges,

inhalers and prescription medications), which helps many people successfully

quit smoking.

It’s never too late to stop

smoking. If you need support or more information, the American Lung Association

is a great resource. Call 1-800-LUNGUSA or visit

LungUSA.org.

Subscribe to:

Posts (Atom)